Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Sales Quantity Variance: Definition, Formula, Explanation, And Example

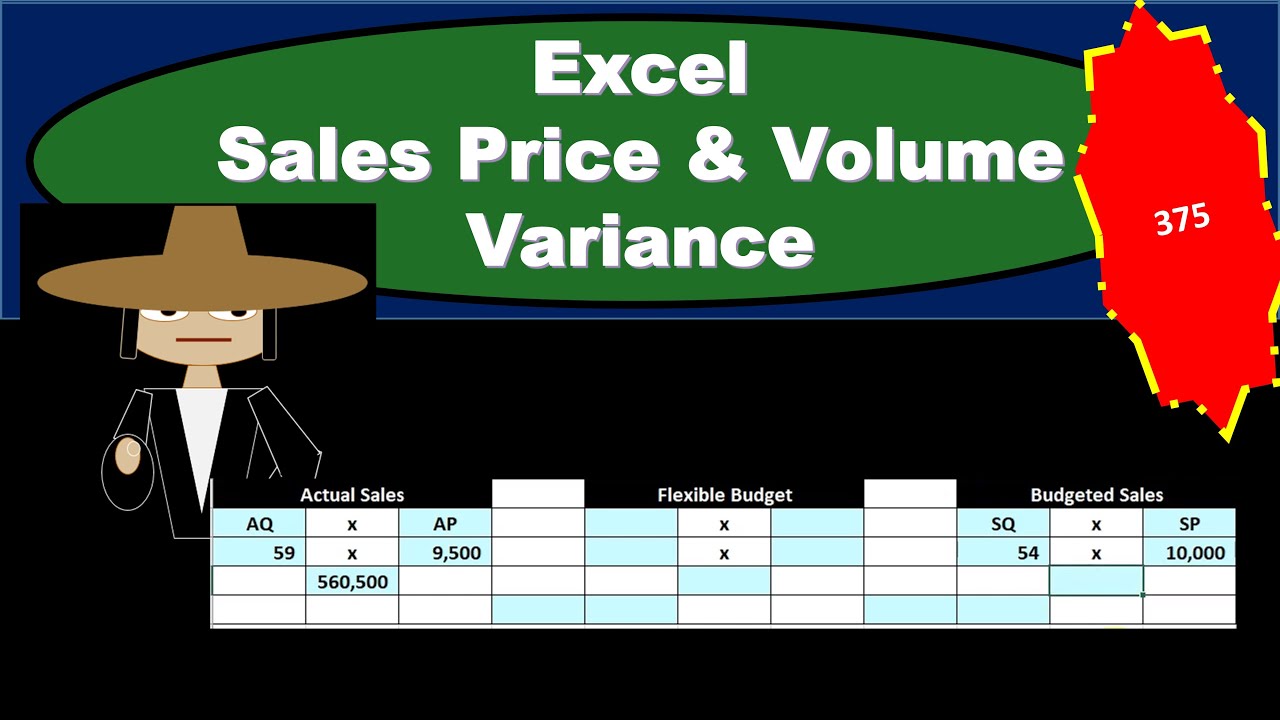

Sales volume variance is a change in sales revenue arising from a difference in budgeted sales quantity and actual quantity sold. It is calculated by multiplying the standard profit per unit with the difference in targeted and actual sales volume. On the other hand, a selling price variance establishes a change in revenue due to a difference in expected and actual selling prices. After the sales results come in for a month, the business will enter the actual sales figures next to the budgeted sales figures and line up results for each product or service.

Table of Contents

Sales Price Variance is the measure of change in sales revenue as a result of variance between actual and standard selling price. A sales value variance, also known as a budgeted profit variance, concerns the difference in budgeted and actual cost of production. It is calculated by subtracting Standard Costs from actual costs, which gives us the net impact on profit.

Sales Dashboard Examples That’ll Help You Set Up Your Own

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The following details are given about a company selling a model of their car for two years. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

(2018 Units Sold – 2017 Units Sold) x 2017 Profit Margin per Unit

Again the term standard price could be used instead of budgeted price in the formula above. Furthermore the total sales variance can be split into two main components. In this post, I’ll show you how to calculate sales variance, which formula to use, and how to use the data to make informed business decisions. Therefore, the selling price variance for XYZ in March 2023 amounts to $4,000. If we calculate our variances correctly, the sum of Price and Volume variances should be equal to the total change in Profit Margin (excluding the impact of cost variances). Similarly the sum of Quantity and Mix variances should equal Volume variance.

Actual sales is the product of actual units sold and actual price per unit. Similarly, actual sales at budgeted price equals the product of actual units sold and budgeted price per unit. Sale price variance is the difference between the actual selling price and the standard selling price set by company. It is the difference between the actual sale amount and budget due to the change in selling price.

Selling price variance can impact the company‘s revenue goals either positively or negatively if it isn’t calculated and anticipated. The selling price variance per unit is calculated by subtracting the actual and budgeted selling prices. It follows the standard formula but ignores the ‘Number of Units Sold’ term. If the actual price is greater than the budgeted price the formula gives a positive result and the sales price variance is a favorable variance. If the actual price is lower than the budgeted price the formula will give a negative result and the sales price variance is said to be unfavorable.

The sales price variance can reveal which products contribute the most to total sales revenue and shed insight on other products that may need to be reduced in price. If a product sells extremely well at its standard price, a company may even consider slightly raising the price, especially if other sellers are charging a higher unit price. Companies can use the sales mix variance to compare a product or product line to their total sales and identify top and bottom performers. Now we are calculating the impact of change in volume (or number of units) and should exclude the impact of change in Profit margin in 2018. Think about it for a little while, internalize it and if you still do not understand, leave a comment and I will try to explain further. However, we need to dig down before reaching conclusion just based on the favorable sales price variance.

The standard selling price is the price that management has estimated during the production process. They predetermine the selling price before the product hit the market. It is the basic which help to support their decision in producing units and profitability.

Sales price variance is adverse when the actual selling price isless than the standard selling price. Sales Price Variance occurs when the actual selling price of a commodity or service differs from the standard selling price set by the management, which is an estimated selling price decided beforehand. The total sales variance is 2,250 the same as calculated above using the sales variance formula. The total sales variance or sales value variance is calculated as follows.

- Sales variance is the difference between actual sales and budgeted sales.[1] It is used to measure the performance of a sales function, and/or analyze business results to better understand market conditions.

- The variance can be favorable, meaning the price was higher than anticipated, or unfavorable, meaning the price failed to meet expectations.

- Sales price variance is a helpful set of calculation for businesses to be aware of their products success in the market and how much they contribute in the overall sales revenue.

- Sales price variance is a measure of the gap between the price point a product was expected to sell at and the price point at which the product was actually sold.

- This calculation of impact of increase in quantity while maintaining the same mix as last year is really our next variance, the Quantity Variance.

The responsibility for a lower rules for claiming a dependent on your tax return typically lies with the sales department but the lower than anticipated sales price may be caused by, for example, poor quality, poor planning, unrealistic budgeting etc. In such cases, the responsibility lies with the production, budgeting, etc. Sale price variance is the difference between the standard price and the actual price that the company has sold the product. The management has already estimated the product price in advance, however, during a product launch, they have set a different price. The market price change all the time due to supply and demand which increase or decrease the price.