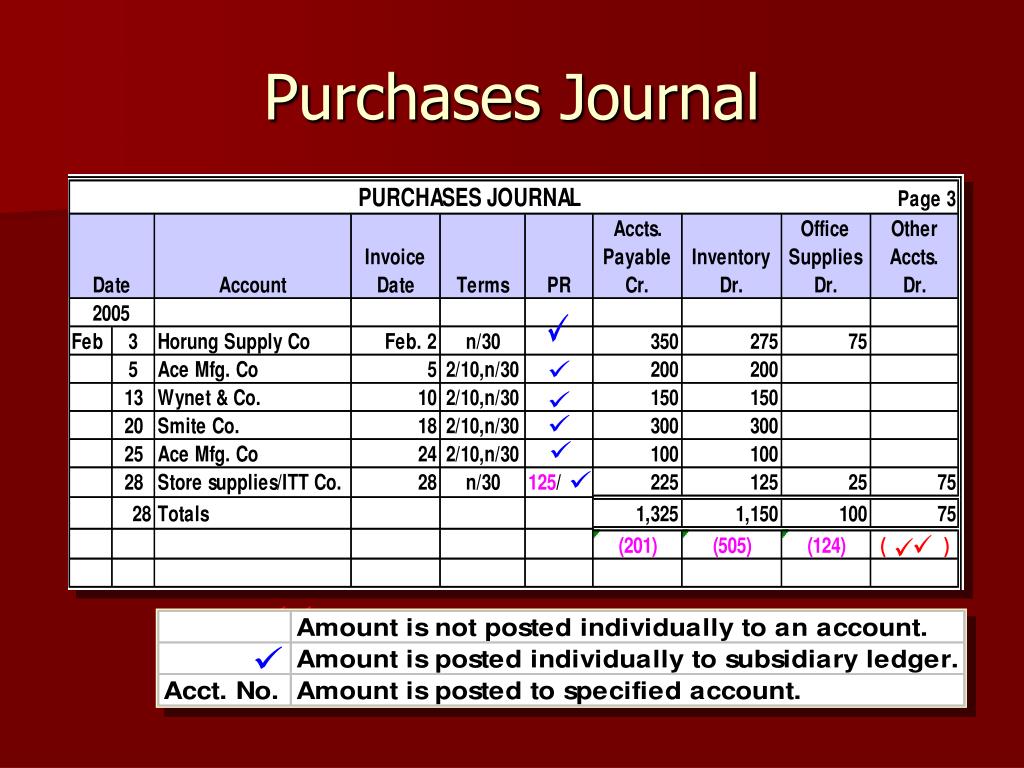

A journal, also known as Books of Original Entry, keeps records of business transactions in a systematic order. On March 28th, Power Tools purchased office supplies on account from Eco Supplies for $750. The bookkeeper might also decide to add a column with a short description of the purchase details. In addition, you will also see the amount of the invoice and specific accounts that were involved in the transaction. Usually, at the end of the month, the bookkeeper will total the amounts for each account and transfer the total to the Purchases account. Credit purchase of current assets/Non current assets are not considered when recording in Purchase journal.

Inventory Purchase Journal Entry

In addition, the company incurred in an obligation to pay $400 after 30 days. That is why we credited Accounts Payable (a liability account) in the above entry. The step variable cost definition journal entry shows that the company received computer equipment worth $1,200. However, there is a decrease in cash because we paid for the computer equipment.

What is the approximate value of your cash savings and other investments?

Transactions are recorded in the journal in chronological order, i.e. as they occur; one after the other. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- ASC 805 replaces FAS 141 which applied to business combinations prior to December 15, 2008.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- The method of payment (cash or credit) influences which accounts are involved in the transaction.

- When the time comes to create your annual budget, a purchase journal helps you estimate how much you’ll need in the coming year for various business expenses.

- The balance in this list is compared with the balance in the general ledger accounts payable account.

- You should update your purchases journal as often as necessary to reflect the most current information.

Books

The DR (debit) Other column would be handled a little differently as you need to look to the account column to find out where these individual amounts should be posted. In this case, we would post a $200 debit to merchandise inventory and a $300 debit to utility expense. Under the periodic inventory method, the July 6 shipping costs would go to a Transportation In account and the July 25 discount would go to Purchases Discounts. The purchasing journal would also record the transaction by debiting inventory, crediting accounts payable and recording the date, invoice, terms, and vendor. The debit typically goes to inventory, but it can also go to other accounts like supplies.

Cash Receipts Journal

It is also posted as a credit in the general ledger accounts payable account. Postings from the purchases journal follow the same pattern as postings from the sales journal. Each day, individual purchases should be posted to the vendor’s account in the accounts payable subsidiary ledger. To record an inventory purchase, debit the Inventory account to increase your stock assets, and credit either Cash or Accounts Payable, depending on whether the purchase was made in cash or on credit.

Supreme Court case New York Times Co. v. Sullivan, which restricted the ability of public officials to sue the media for defamation. A cash purchase of inventory results in a decrease in the Cash account, impacting the cash flow statement by reducing the cash available for operations and other activities. You will have no trouble as long as you know how to use debits and credits and what accounts to record. On March 16th, Power Tools purchased inventory on account from Brown Manufacturing for $4,345.

Additional factors, such as freight charges and purchase discounts, can also affect the journal entry for inventory purchases. If the purchase is made in cash, credit the Cash account to decrease the company’s cash on hand, showing that cash has been spent to acquire inventory. When there is only one account debited and one credited, it is called a simple journal entry.

A purchases journal is a subsidiary-level journal in which is stored information about purchasing transactions. This journal is most commonly found in a manual accounting system, where it is necessary to keep high-volume purchasing transactions from overwhelming the general ledger. All types of purchases made on credit are recorded in the purchases journal, including office supplies, services, and goods acquired for resale. Purchase journals are a vital part of the accounting process of any organization. When implemented carefully, a sound system will help in just-in-time purchases, which will lead to saving in time and money.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. A version of this list appears in the November 17, 2024 issue of The New York Times Book Review. Rankings on weekly lists reflect sales for the week ending November 2, 2024. This decreases the cash balance, indicating money paid out for the purchase. On the next page we will present more examples of recording transactions using a comprehensive illustrative case.

This can help eliminate the possibility of mistakes being made in the journal. The Times was founded as the conservative New-York Daily Times in 1851, and came to national recognition in the 1870s with its aggressive coverage of corrupt politician William M. Tweed. Following the Panic of 1893, Chattanooga Times publisher Adolph Ochs gained a controlling interest in the company. In 1935, Ochs was succeeded by his son-in-law, Arthur Hays Sulzberger, who began a push into European news. Sulzberger’s son-in-law Arthur Ochs became publisher in 1963, adapting to a changing newspaper industry and introducing radical changes.